Inflation Reduction Act

The Inflation Reduction Act’s Impact on South Carolina’s HVAC Industry

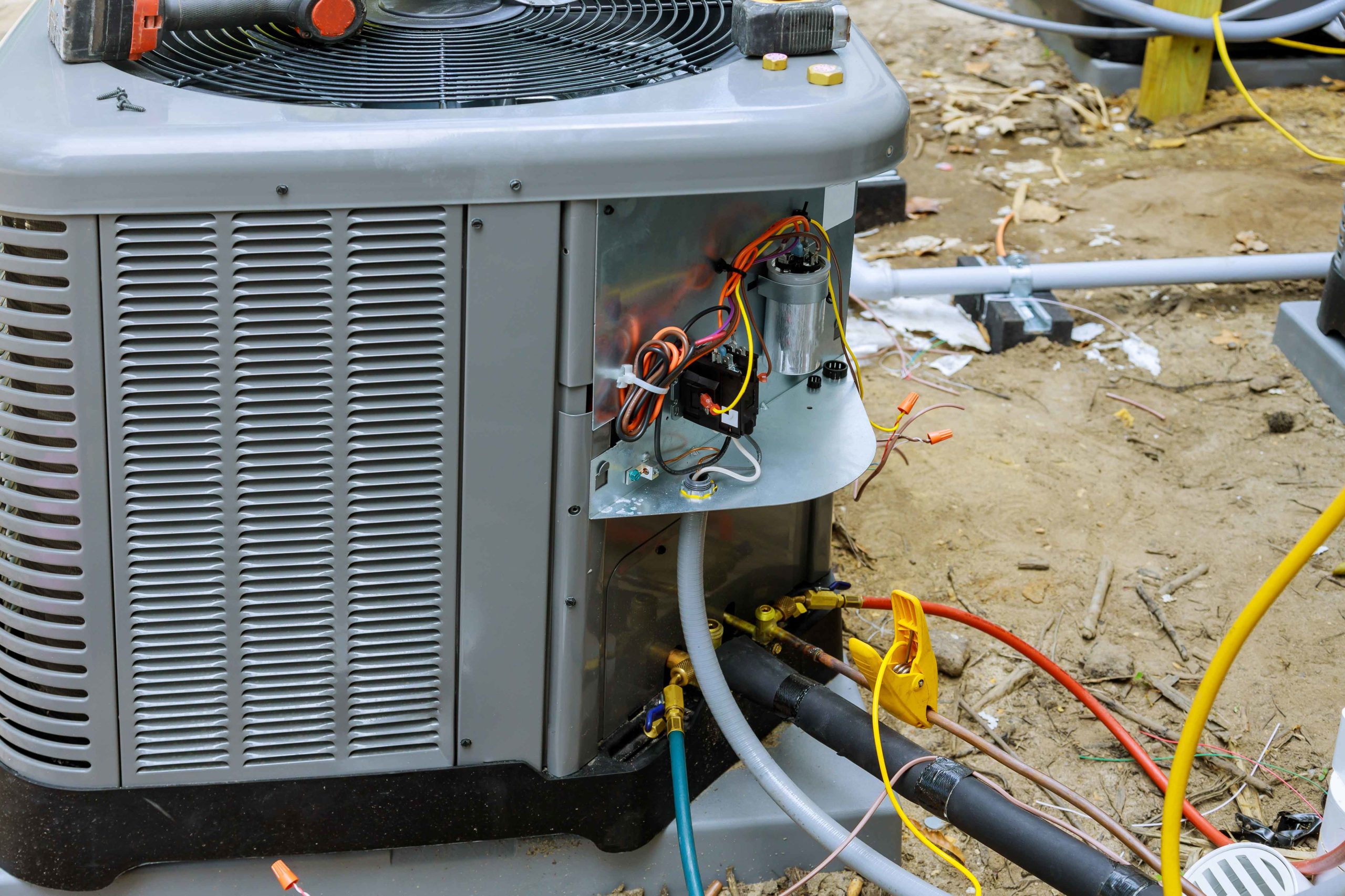

The Inflation Reduction Act of 2022 (IRA) is a comprehensive energy policy bill that was signed into law August 16, 2022, by President Joe Biden. It incentivizes homeowners, business owners, and contractors to install and upgrade heating and cooling systems to higher energy-efficient systems to reduce greenhouse gas emissions.

The Act includes tax credits and rebates to incentivize energy-efficient home upgrades by rewarding homeowners for purchasing qualifying high-efficiency HVAC systems, including furnaces, central air conditioning systems, heat pumps, fans, and more. The initiative aims at reducing homeowners’ reliance on natural gas, encouraging residents to switch to electrical appliances, and reducing each building’s overall environmental impact.

The objective is to combat inflation, allocate resources towards domestic energy production and manufacturing, and lower carbon emissions. The IRA provides a record $370 billion for climate and energy initiatives, the most significant investment in U.S. history to flight climate change. The incentives in this bill are predicted to result in millions of homes and businesses completing energy-efficient upgrades in the coming months.

The Inflation Reduction Act significantly impacts South Carolina’s HVAC industry. HVAC contractors can leverage the tax credits when selling system upgrades to their customers, resulting in more business. In addition, the IRA is the way to get leading technology and high-efficiency products into homes and businesses.

The Impact of the IRA on Homeowners in South Carolina

The Inflation Reduction Act in will have a significant impact on South Carolina homeowners, including:

Lowering the Energy Costs

Homeowners in South Carolina can benefit from the IRA through a home energy rebate program and tax credits on home energy upgrades. The legislation sets apart $9 billion for rebates that will make it easier for homeowners in low- and middle-income households to afford energy-efficient appliances such as heat pumps.

The IRA provides specific incentives across the entire energy chain from the grid to the plug, with substantial savings opportunities for improvements made within homes.

Creating Good Paying Jobs

The Inflation Reduction Act will positively impact job creation in South Carolina, particularly in the clean energy sector. In 2021, South Carolina already had a considerable workforce of 44,011 workers employed in the clean energy section. The Act is expected to enhance this trend by bringing in an estimated $15 billion of investment in large-scale clean power generation and storage to the state between now and 2030.

In addition, the influx of investment will stimulate the local economy and support the development of new businesses while attracting talent and promoting innovation.

Promoting Domestic Manufacturing

South Carolina is already home to 249,400 manufacturing workers, and the Act is expected to further boost this industry by promoting the production of clean energy and transportation technologies within the country. The act will achieve this by:

- The investment in the new Advanced Industrial Facilities Deployment Program aims to position America as the leader in the expanding global market for clean steel, aluminum, cement, and other related products. In addition, by investing the developing these technologies, the Act will create opportunities for domestic manufacturing, which will positively impact local economies and strengthen supply chains.

- The Act’s focus on clean energy and transportation technologies will create demand for locally produced components and equipment. This increased demand for domestic production will support South Carolina’s manufacturing sector and encourage companies to produce their products in-state.

Boosting Small Businesses

The Inflation Reduction Act will benefit small businesses in South Carolina by providing tax credits for energy efficiency improvements in commercial buildings. Commercial building owners can receive a tax credit for up to $5 per square foot for making improvements that deliver lower utility bills. This will help small businesses save money on their energy bills and reduce their overall operating costs.

Key Takeaways

The Inflation Reduction Act (IRA) was signed into law on August 16, 2022, and provides several incentives for homeowners, business owners, and contractors to install and upgrade heating and cooling systems to higher energy-efficient systems to reduce greenhouse gas emissions.

With the Inflation Reduction Act, providing incentives for homeowners to upgrade their HVAC systems to more energy-efficient models, heating, and air conditioning companies such as Smoak’s Comfort Control can help you take advantage of these incentives. We are a reputable, third generation, locally family-owned and operated HVAC company that can provide you with high-quality HVAC services including installation, repair, and maintenance. By upgrading your HVAC system to a more energy-efficient model, you can save money on your energy bills and contribute to reducing carbon emissions.

We can also help you navigate the incentives provided by the Act and ensure you get the most out of them. So, don’t wait to upgrade your HVAC system and take advantage of the incentives provided by the IRA. Instead, contact us today to schedule an appointment and save money on your energy bills.

Visit Trane’s special offers page for more information on tax credits, rebates, and promotions. To schedule an appointment or learn more about how working with a HVAC professional like Smoak’s Comfort Control can save you money, improve your quality of life, and more, contact us today!